Unlock Higher Returns with Data-Driven Factors on Productivity

Gain actionable insights and outperform benchmarks by leveraging comprehensive analysis of asset, process, resources, and resilience productivity factors.

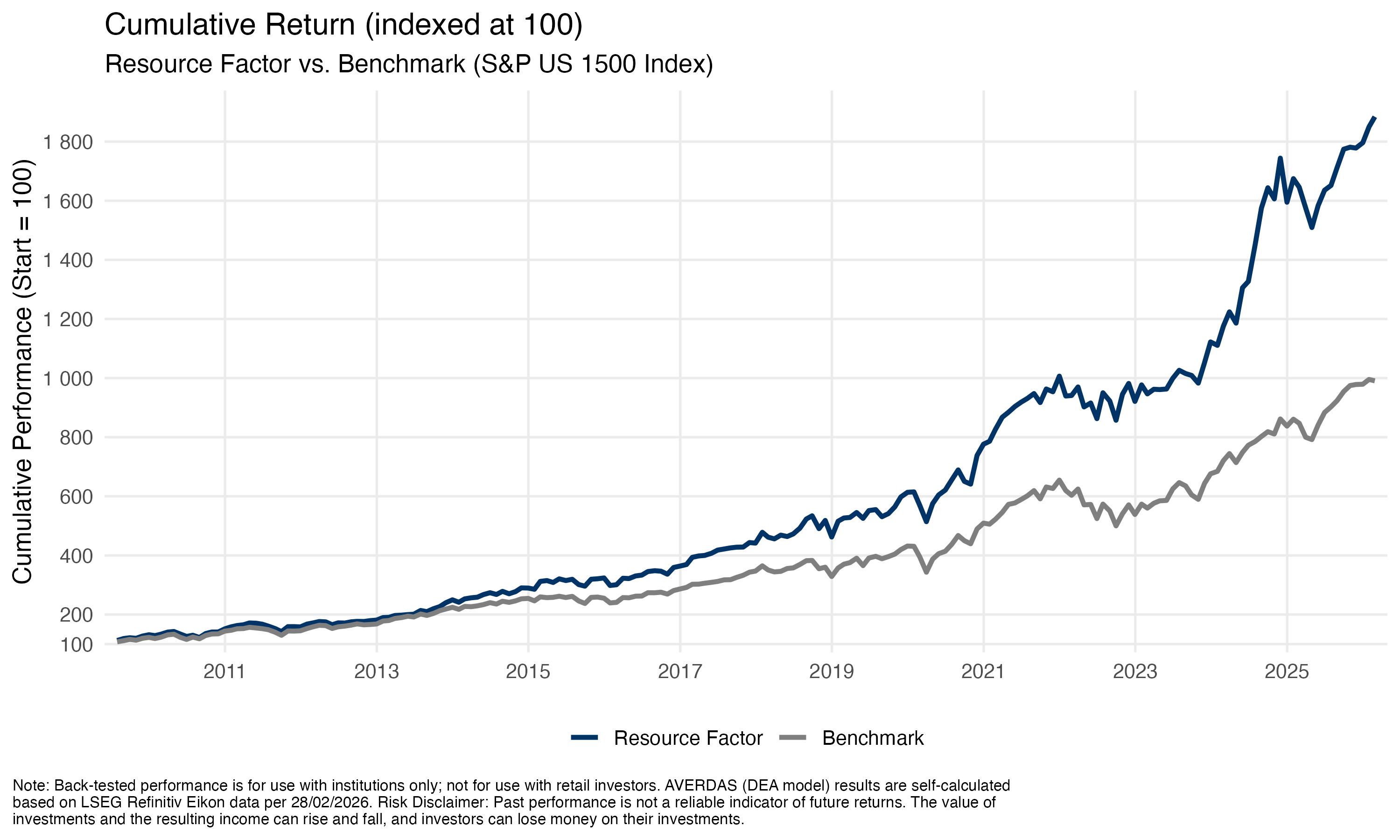

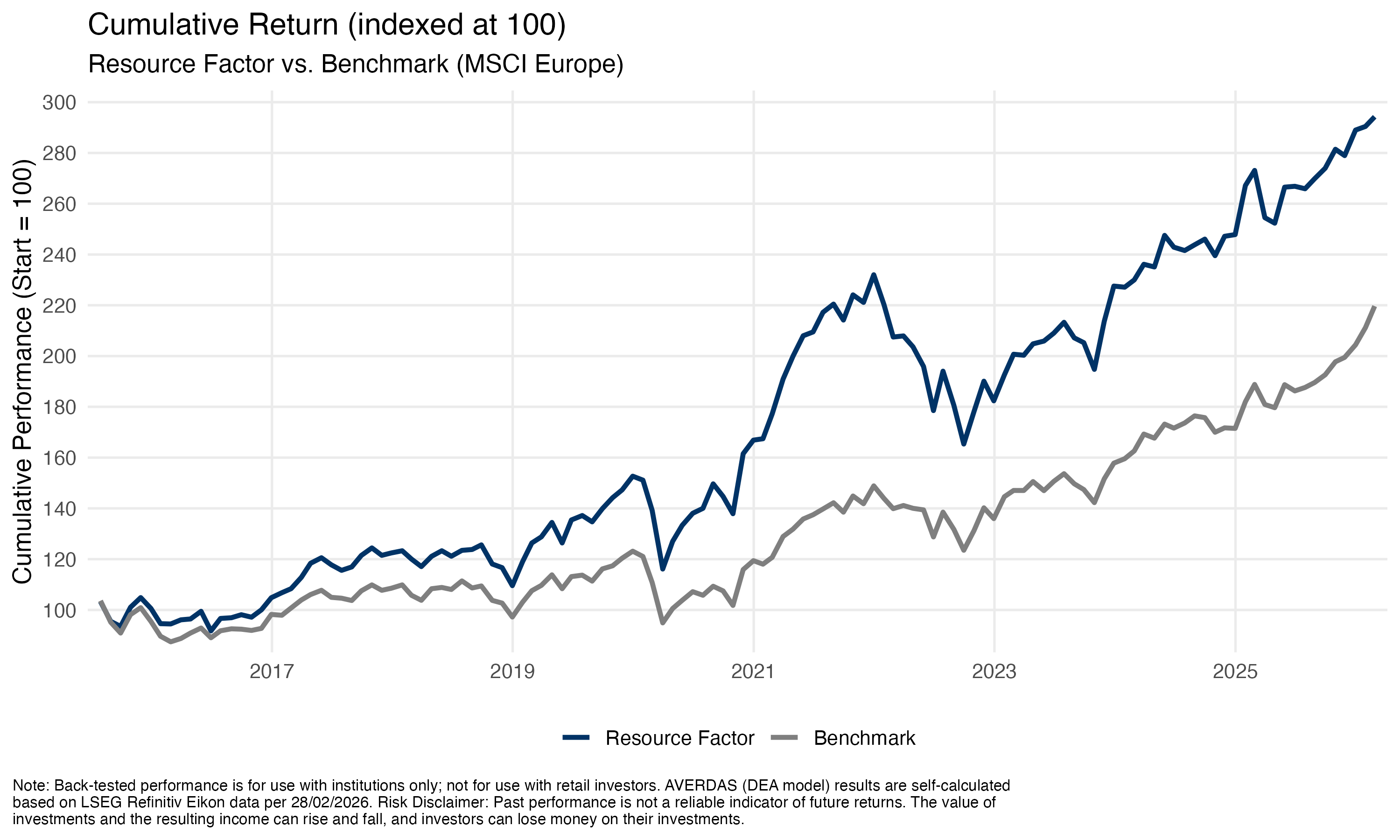

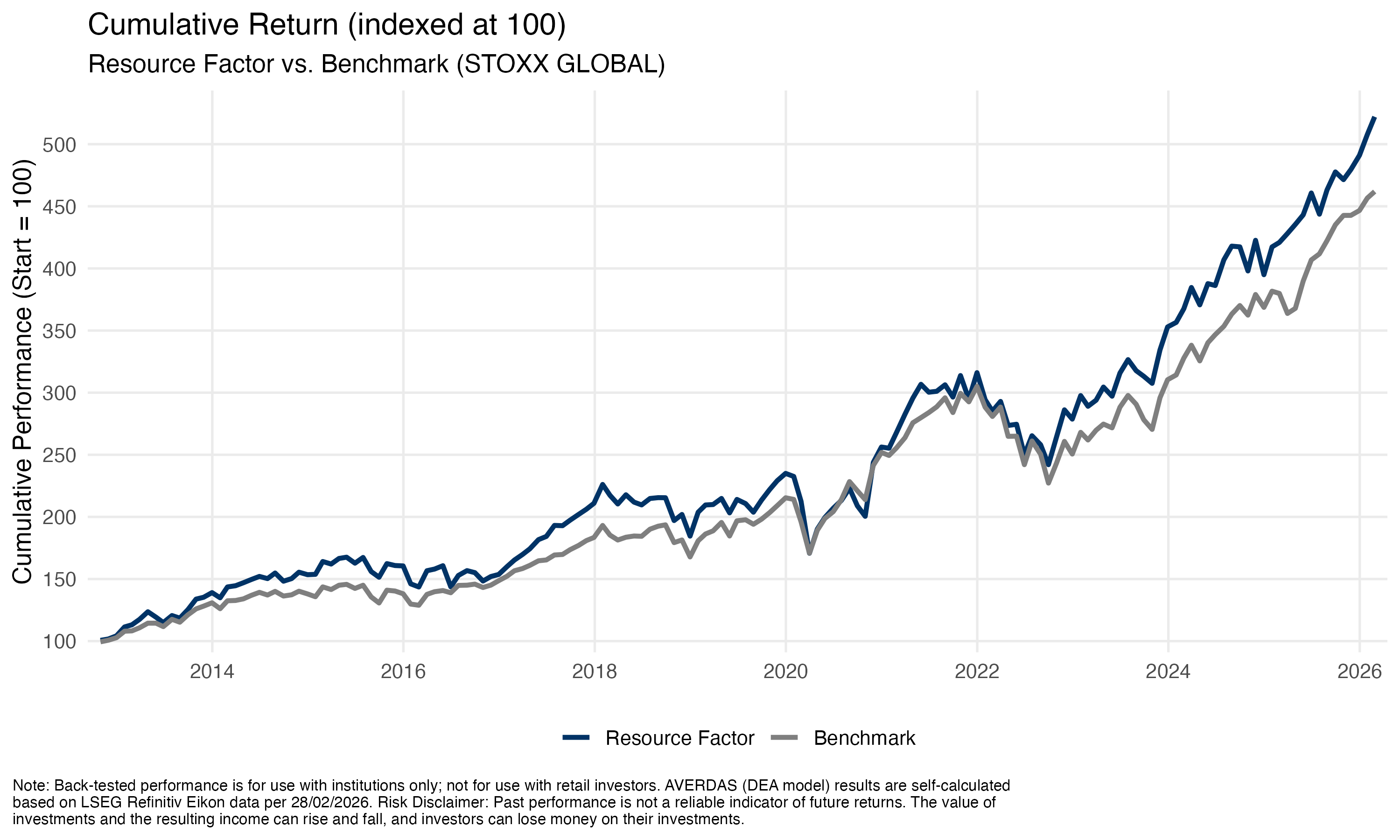

Resource Factor

Make the Business

For sustainable business enabled by efficient use of resources.

How resource factor works?

Resource-efficient stocks tend to outperform resource-inefficient stocks over the long term. This is known as the resource-efficiency-score.

Why they outperform resource-ineffective stocks?

Organizations with a focus on reducing the consumption of resources have better stakeholder scores (i.e., ESG) and higher shareholder values, leading to higher returns.

Make the Business

Resource Factor

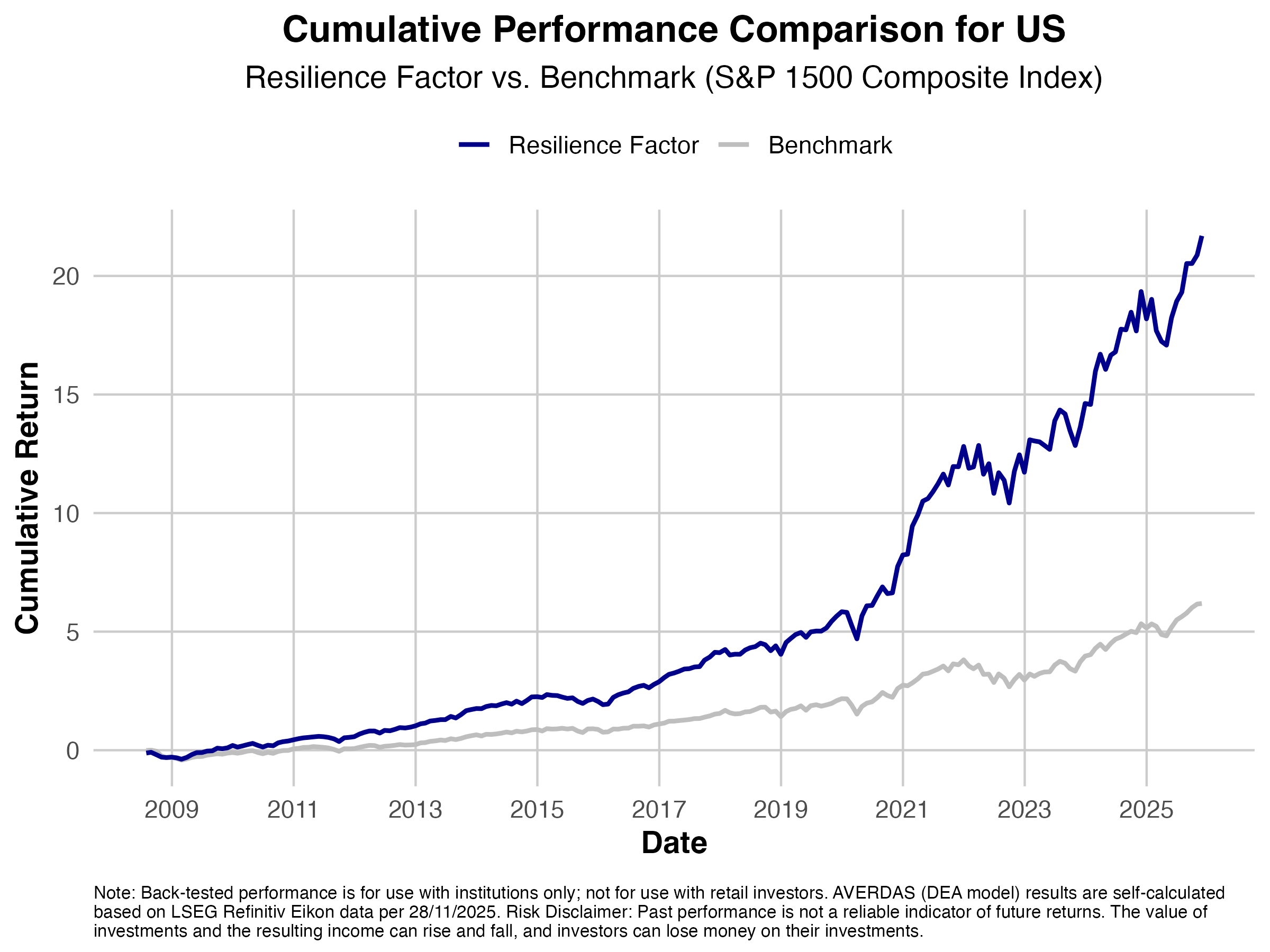

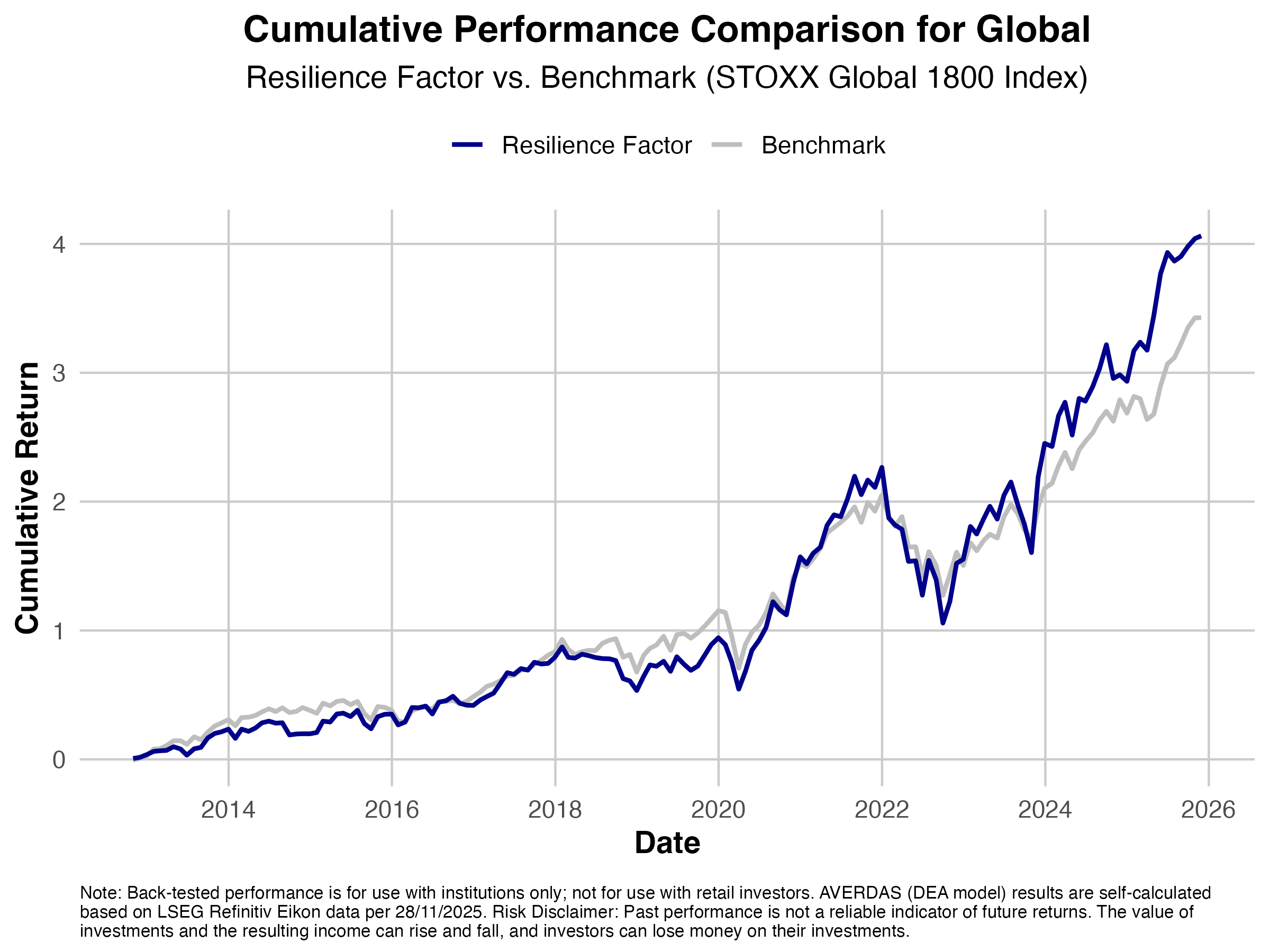

Resilience Factor

Stabilize Business

For stable business enabled by the ability to adapt quickly on a strategic and operational level.

How resilience factor works?

Resilient organizations better cope with disruptive events , “bounce back” faster to a pre disruption state, and “bounce forward” toward unprecedented futures.

Why they outperform resource-ineffective stocks?

Organizations having high resiliency anticipate, adapt and recover better from disruptive events on the systematic, strategic and operational level leading to higher stable returns.

Stabilize the Business

Resilience Factor

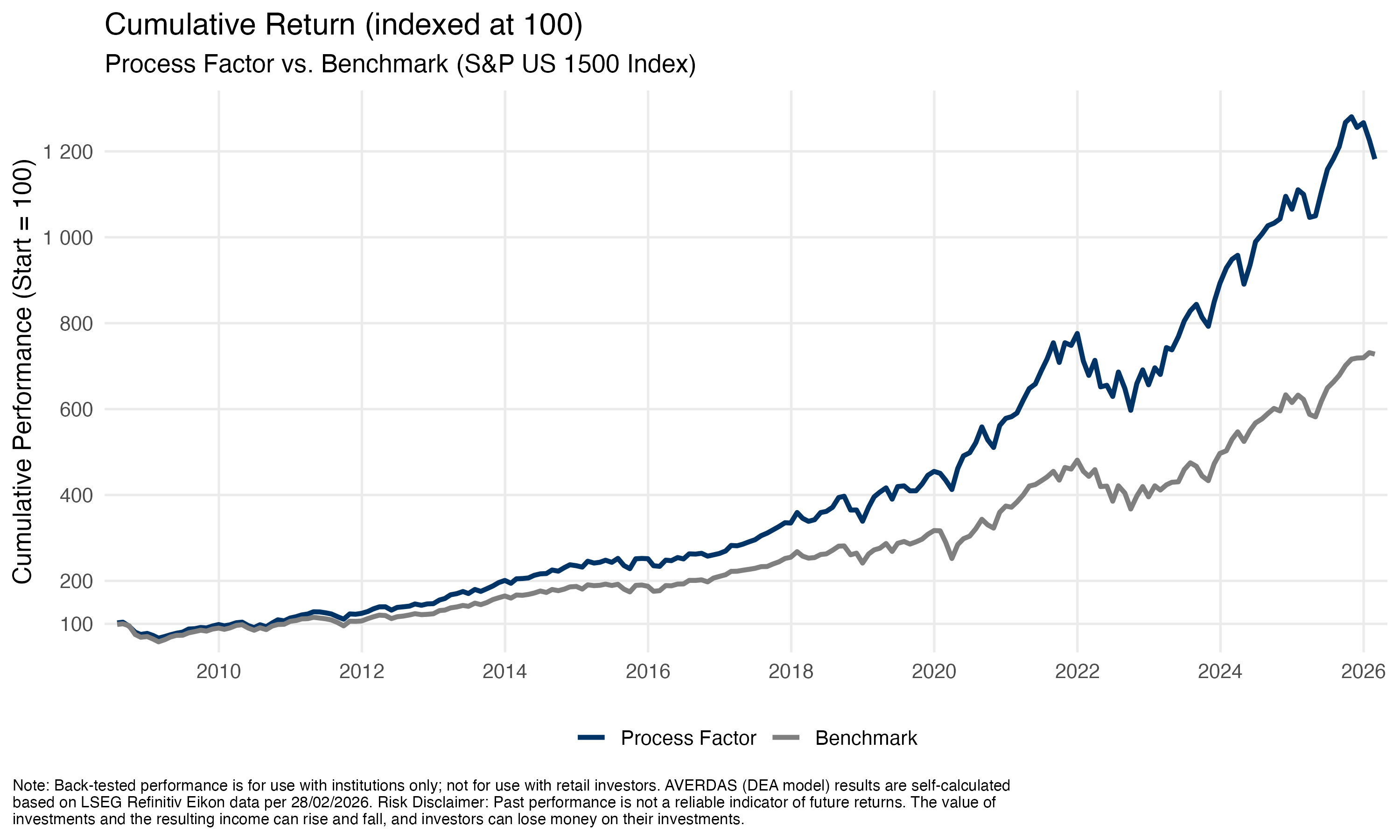

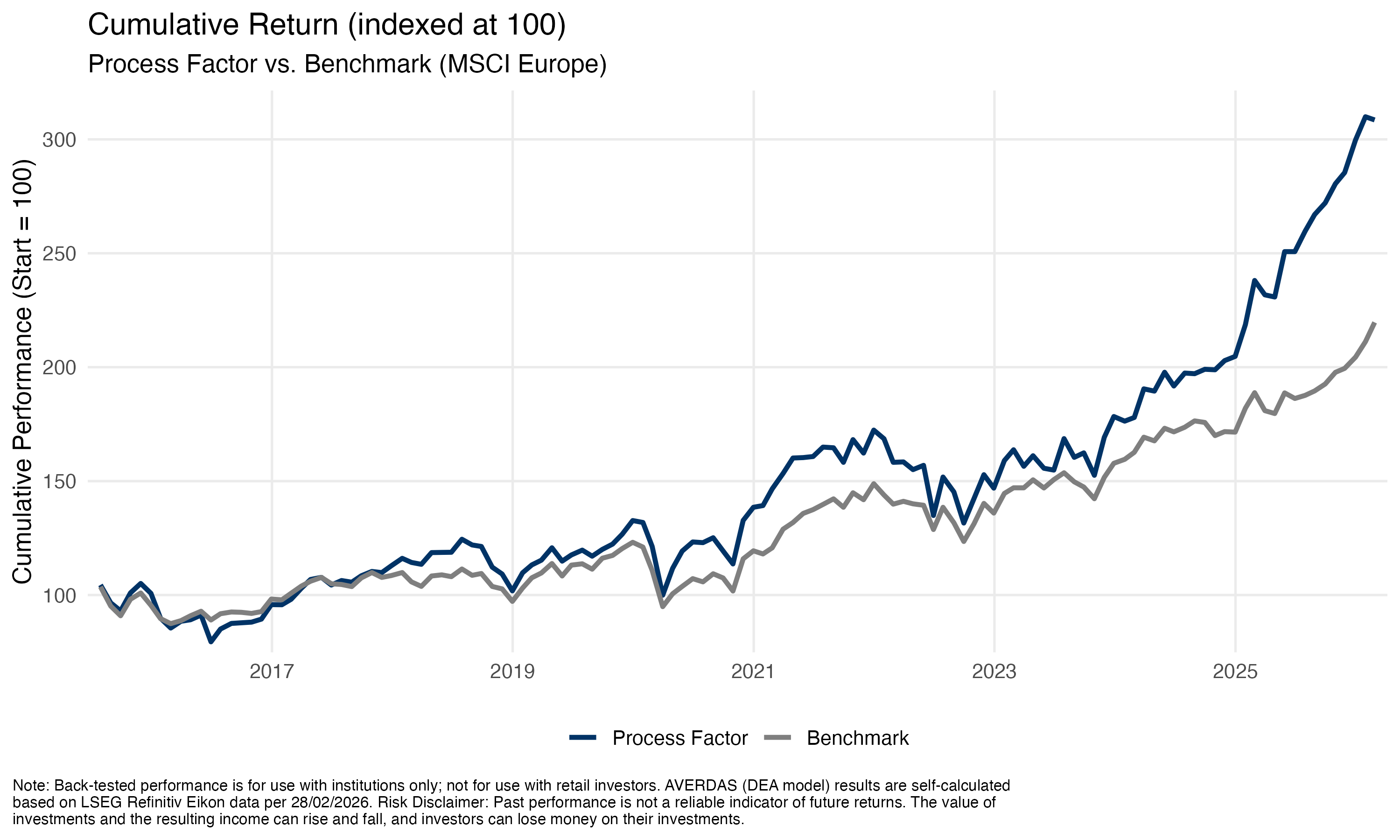

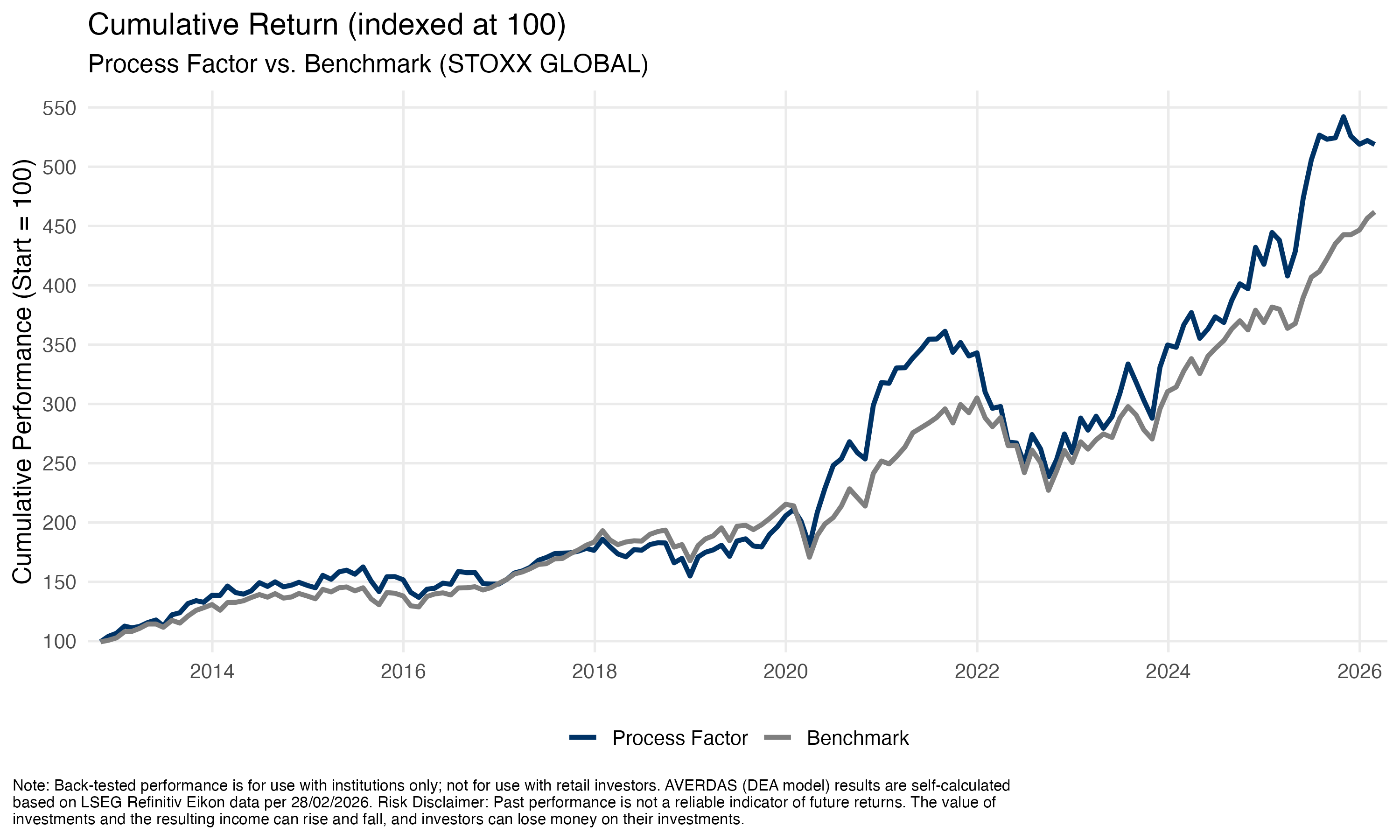

Process Factor

Run the Business

For profitability enabled by efficient use of operational capabilities.

How process factor works?

Process-efficient stocks tend to outperform process-inefficient stocks over the long run. This is known as the operating frontier.

Why they outperform process-ineffective stocks?

Organizations with better dynamic organizational capabilities are more efficient and aligned to the VUCA environment, leading to higher returns.

Run the Business

Process Factor

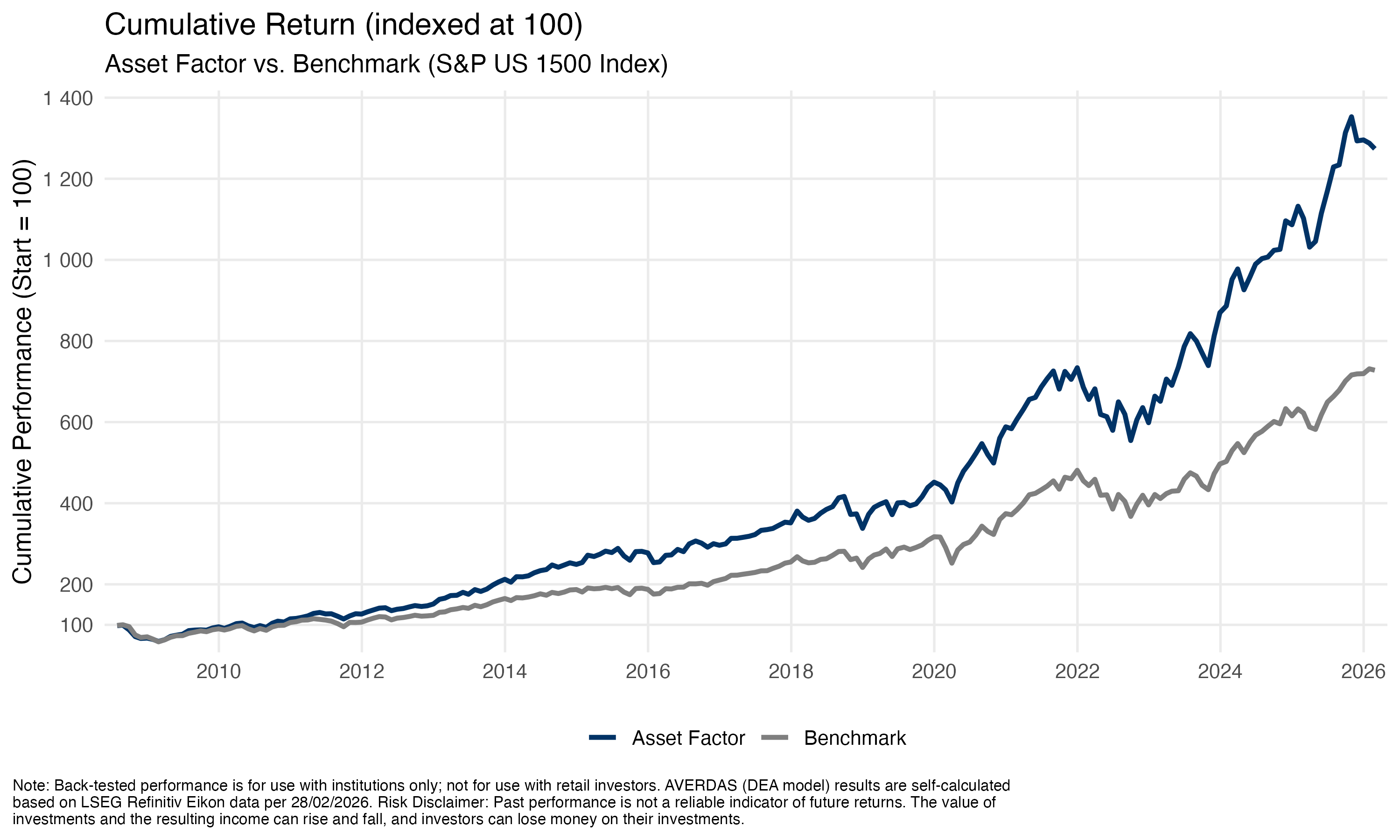

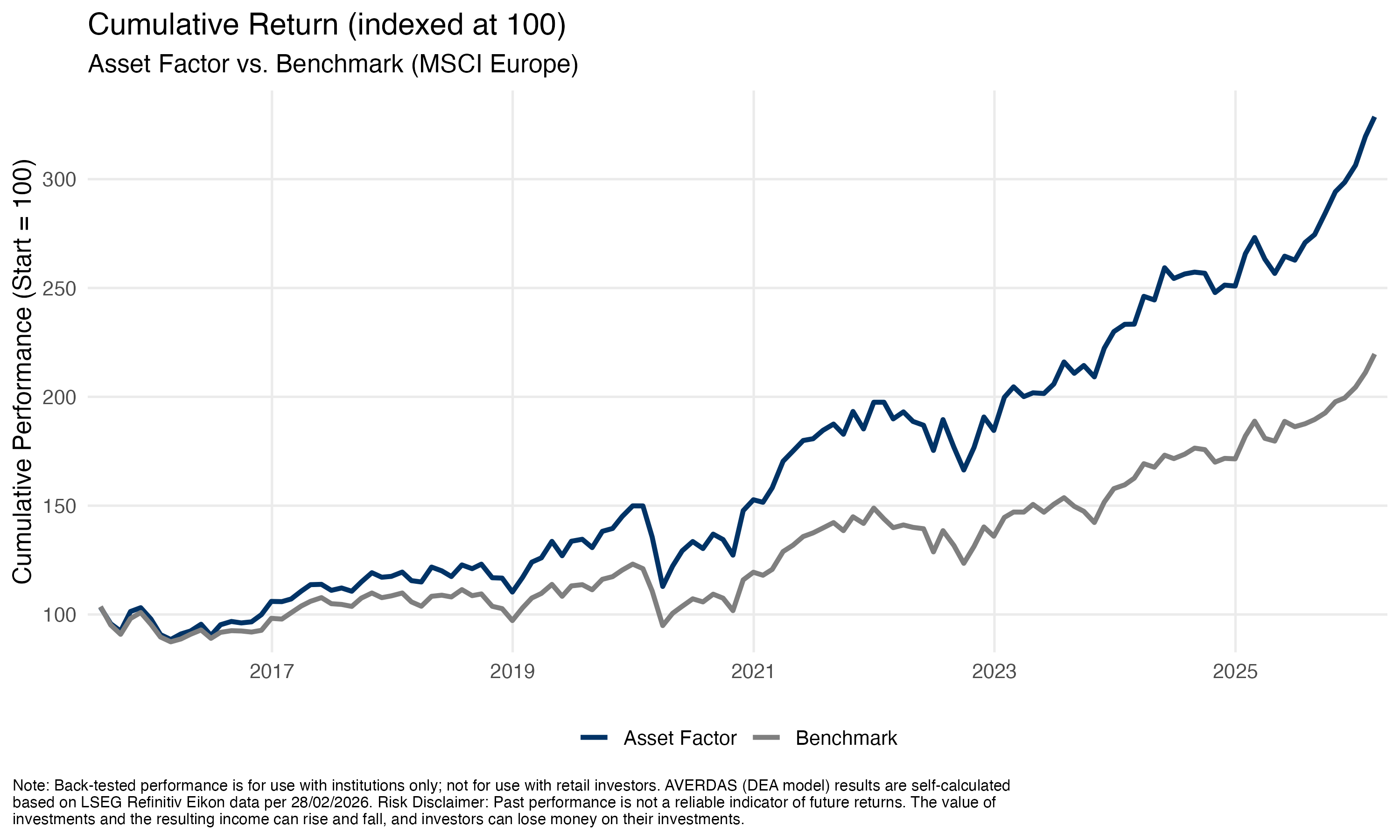

Asset Factor

Build the business

Long term growth enabled by effective use of assets like labor, capital and technologies.

How asset factor works?

Asset-effective stocks tend to outperform asset-ineffective stocks over the long term. This is known as the organizational production possibility frontier.

Why they outperform asset-ineffective stocks?

Organizations that fully utilize their assets will produce a higher quantity of goods more efficiently, leading to higher revenues.

Build the Business

Asset Factor

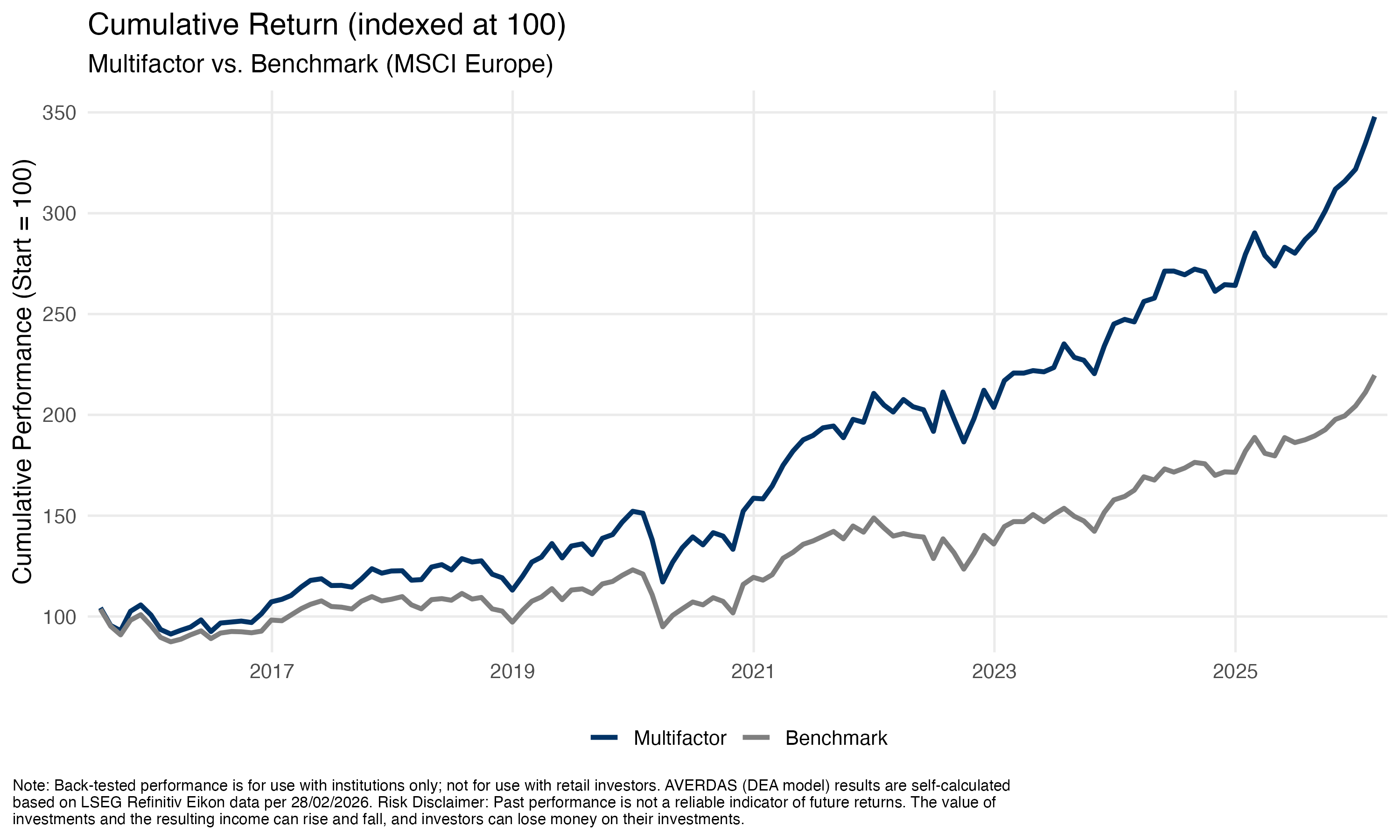

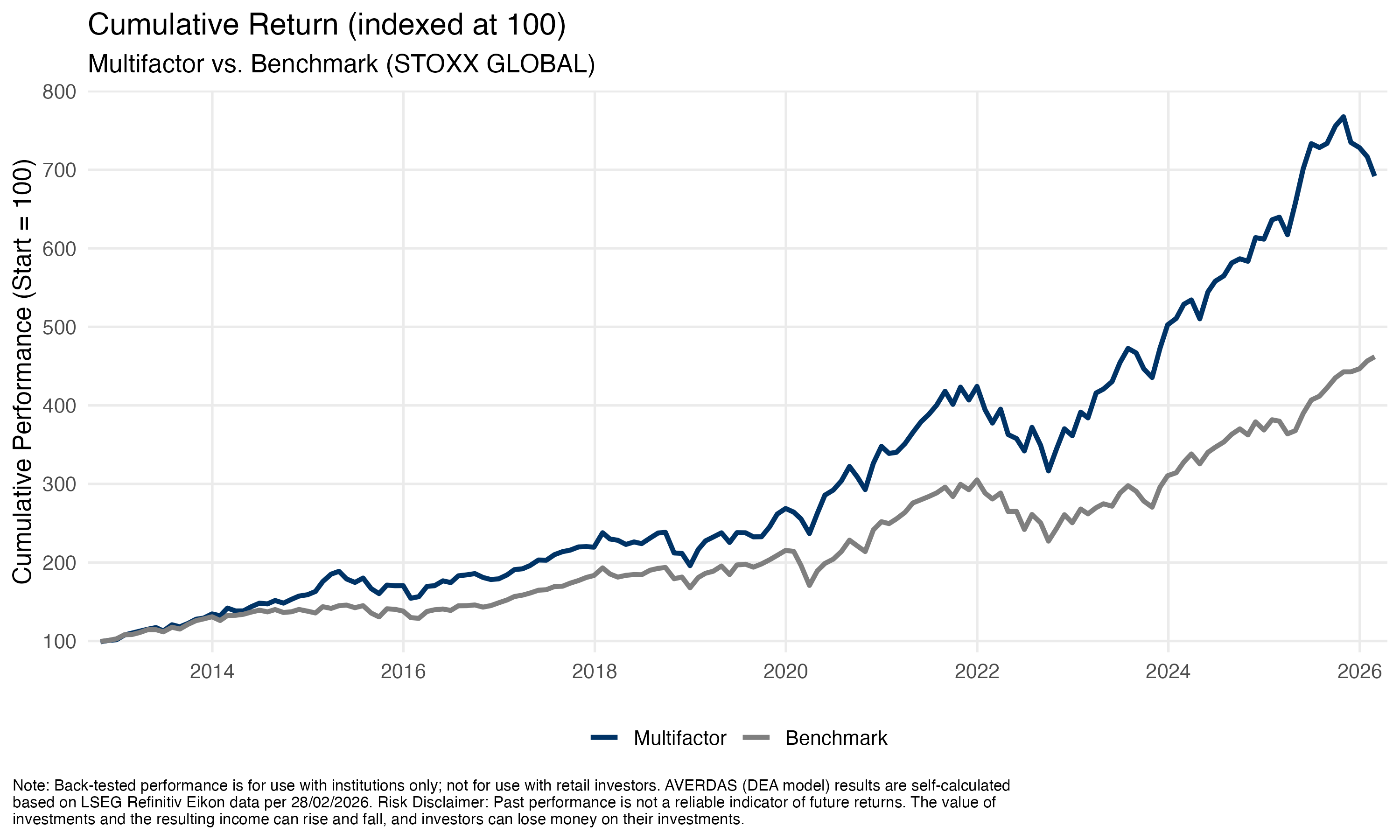

Multi Factor

After calculating each score, a multi-step procedure is applied to identify and select the best performing companies in terms of innovation-productivity, process-productivity, and resiliency. Step 2 builds on Step 1 by selecting the TOP 50 process-efficient companies from the TOP 100 innovation-efficient companies. In step 3 the TOP 20 performing resilient companies are matched with the TOP 50 of the identified companies after step 2. The remaining “spaces” are filled with the TOP 50 companies after step 2. This procedure ensures that the final selection embodies the best performing firms. This approach prevents over-reliance on any single factor while combining the benefits of growth, profitability, and stability.

Multi Factor

Productivity Factors in Investing

Data-Driven Asset Selection

Identification of Non-Linearities and Inefficiencies in the Market

.jpg)

Quantitative and Sophisticated Mathematical Model for Selection

.jpg)

Scientifically Proven Approach

.jpg)

Identification of Robust and Alpha-generating Productivity Leaders

.jpg)

Higher Returns Independent of Macro-Economic Cycles

.jpg)

Sector and Industry Independent

.jpg)

Size

Smaller, high-growth companies

Quality

Financially healthy companies

Momentum

Stocks with upward pricetrends

Carry

Income incentive to hold

riskier securities

Value

Stocks discounted relative

to their fundamentals

Minimum volatility

Stable, lower-risk

stocks

Quality

Financially healthy companies

Momentum

Stocks with upward pricetrends

Size

Smaller, high-growth companies

Similar Inputs Lead To Similar Results

Most investors use similar inputs in similar ways, leading to similiar results, including well-known factors such as quality, momentum, growth, value, dividends, low volatility, and size.

We at Averdas use data differently, apply different algorithms for different insights and build our new factors on productivity. With our approach we are able to identify productivity leaders that generate superior returns independent of macro-economic cycles.

Solactive Averdas Indices

Leverage Data-Driven Productivity Insights for Superior Index Performance

Multi-Factor Indices: Combining Factors

While powerful individually, factors also can be used in combination to reflect market outlook and investment objectives. Some common factor combinations include:

Asset + Process

Asset + Resource

Asset + Resilience

Resource + Resilience

Process + Resource

Process + Resilience

Averdas Factor Indices Summary

U.S. equities were volatile in February as the largest growth and technology names fell, and parts of the "mega-cap" complex saw a corrective tone. Investors focused on earnings quality and guidance credibility, especially where demand and disinflation matter.

European stocks remained resilient in February due to steady economic conditions and positive corporate updates. Markets benefited from cooling inflation and a stable policy environment, fostering confidence in the earnings outlook. Sector dispersion persisted, but the overall tone in Europe remained constructive compared to the U.S., supported by a series of encouraging results and improved sentiment.

Global equities were mixed, with clear regional differences. Outside the U.S., several developed markets performed well, but parts of Asia remained fragile as foreign flows remained cautious, particularly in technology-heavy markets facing valuation sensitivity and heightened geopolitical risk. China remained a focal point, with authorities balancing market-supportive goals against tighter oversight and ongoing structural challenges, leaving investors selective and quick to de-risk on negative headlines.

Overall: In February, the U.S. showed more rotation and narrower leadership, Europe remained steady, and global markets advanced amid uncertainty. Equity performance is driven by earnings and clarity, so markets may fluctuate when those signals change.

Source: Averdas Ag. Data as of 30. February 2026. Index performance based on total return (EUR/(USD)

Understanding the Full Scope of Productivity Factors

Asset Factor

Process Factor

Resilience Factor

Resource Factor

Multi-Factor

US

Asset Factor

US

.jpg)

Process Factor US

.jpg)

Resilience Factor US

.jpg)

Resource Factor US

.jpg)

Multi-Factor

US

.jpg)

Europe

Asset Factor Europe

.jpg)

Process Factor Europe

.jpg)

Resilience Factor Europe

.jpg)

Resource Factor Europe

.jpg)

Multi-Factor Europe

.jpg)

Global

Asset Factor Global

.jpg)

Process Factor Global

.jpg)

Resilience Factor Global

.jpg)

Resource Factor Global

.jpg)

Multi-Factor Global

.jpg)

.webp)

.avif)